(1)分期付款是一种买卖交易,买者不仅获得了所交易物品的使用权,而且获得了物品的所有权。而融资租赁则是一种租赁行为,尽管承租人实际上承担了由租赁物引起的成本与风险,但从法律上讲,租赁物所有权名义上仍归出租人所有。

(3)上面两条导致两者在税务待遇上也有区别。融资租赁中的出租人可将摊提的折旧从应计收入中扣除,而承租人则可将摊提的折旧费从应纳税收入中扣除,在分期付款交易中则是买方可将摊提的折旧费从应纳税收入中扣除,买者还能将所花费的利息成本从应纳税收入中扣除,此外,购买某些固定资产在某些西方国家还能享受投资免税优惠。

(4)在期限上,分期付款的付款期限往往低于交易物品的经济寿命期限,而融资租赁的租赁期限则往往和租赁物品的经济寿命相当。因此,同样的物品采用融资租赁方式较采用分期付款方式所获得的信贷期限要长。

(5)分期付款不是全额信贷,买方通常要即期支付贷款的—部分;而融资租赁则是一种全额信贷,它对租赁物价款的全部甚至运输、保险、安装等附加费用都提供资金融通。虽然融资租赁通常也要在租赁开始时支付一定的保证金,但这笔费用一般较分期付款交易所需的即期付款额要少得多(例如在进出口贸易中买方至少需现款支付15%的货款)。因此,同样一件物品,采用融资租赁方式提供的信贷总额一般比分期付款交易方式所能够提供的要大。

(6)融资租赁与分期付款交易在付款时间上也有差别。前者一般在每期期末,通常在分期付款之前还有一宽限期,分期付款一般没有宽限期,交易开始后就需支付租金,因此,分期款支付通常在每期期初。

(8)融资租赁的对象一般是寿命较长、价值较高的物品,如机械设备等。

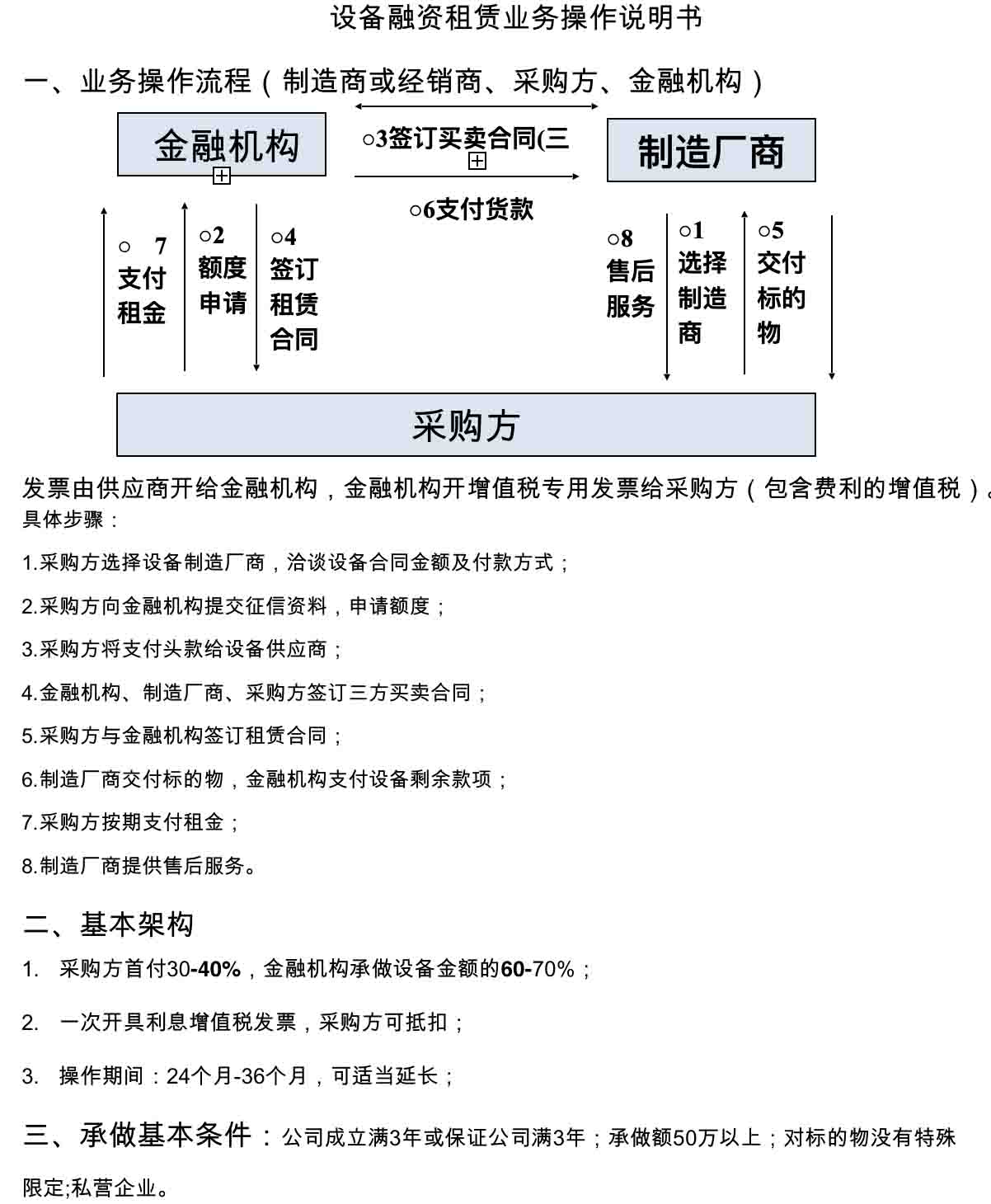

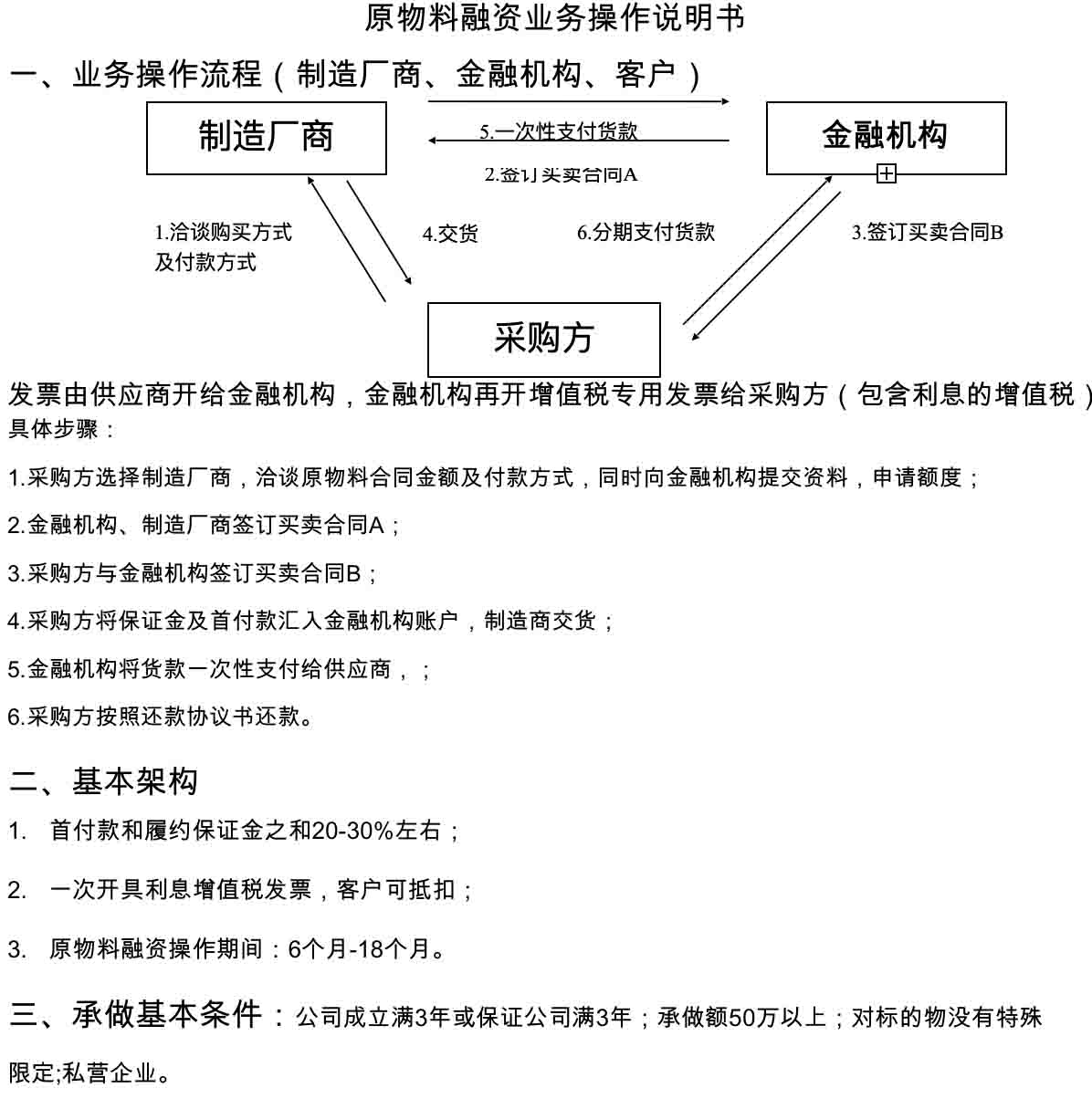

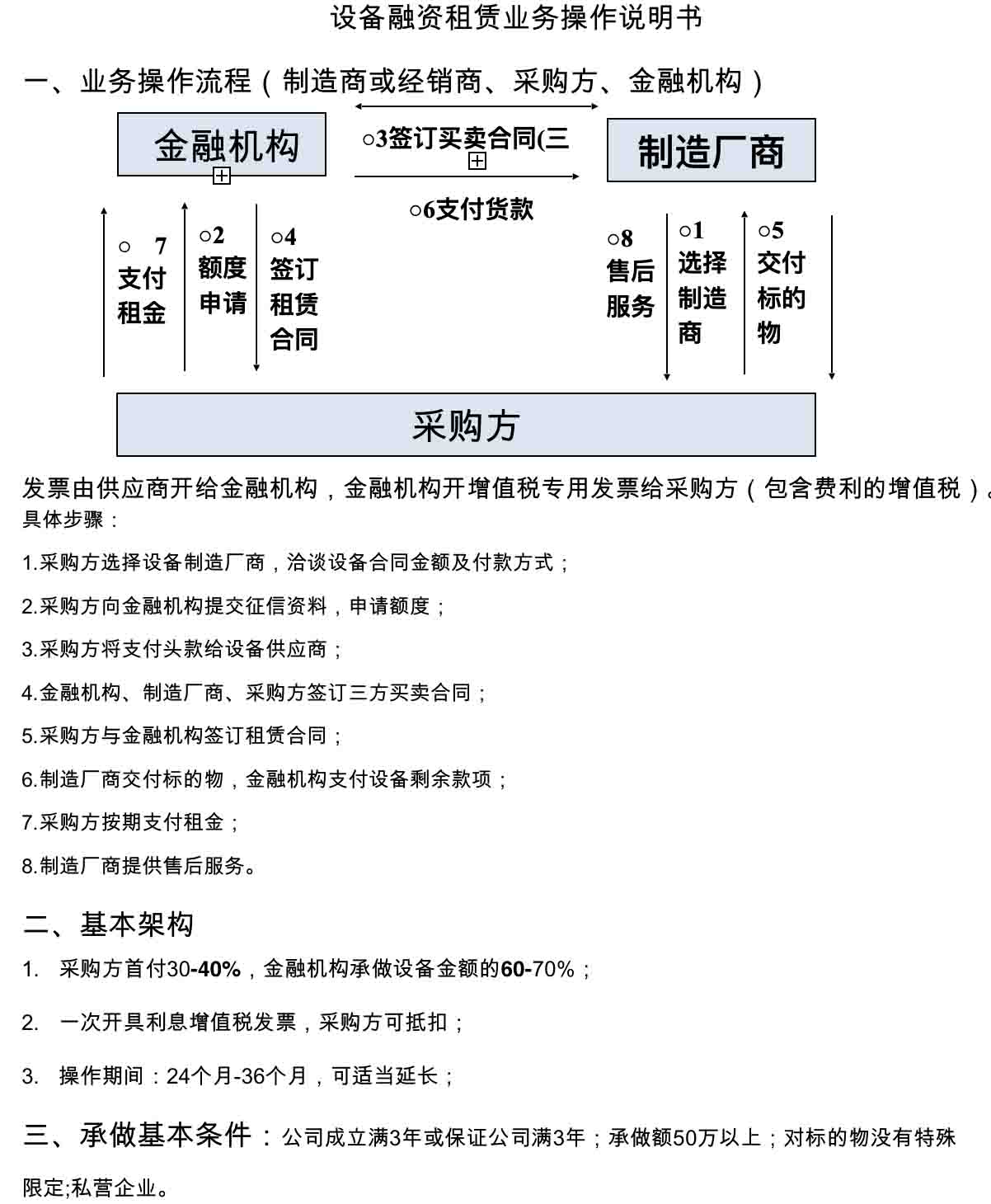

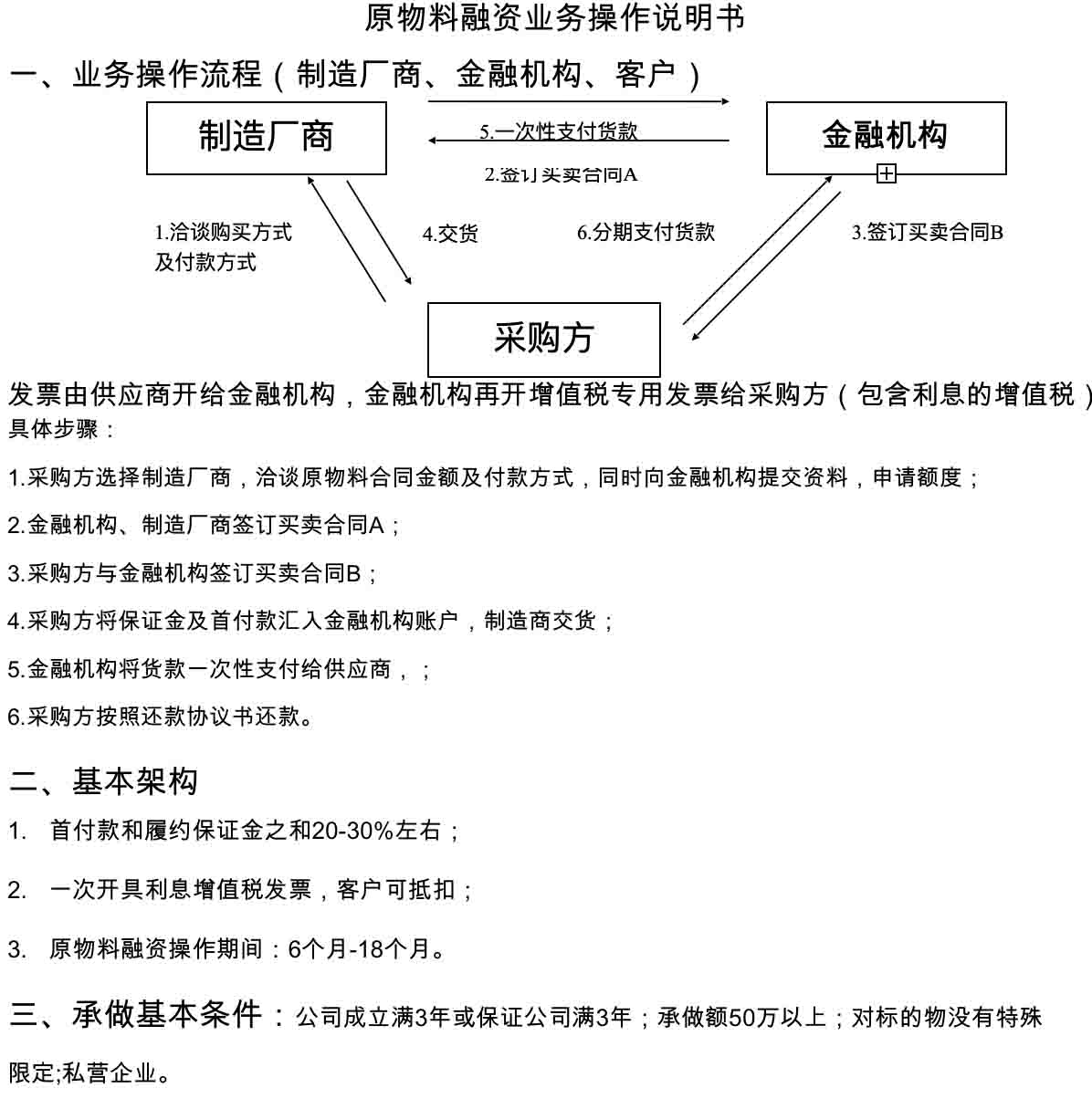

When you do not have enough working capital, and you have to invest a large amount of fixed assets - machinery, you can consider cooperating with us to carry out the following operations:

One of the essential differences between financial leasing and traditional leasing is that traditional leasing calculates rent according to the time when the lessee leases the objects, while financial leasing calculates rent according to the time when the lessee occupies the financing cost. It is a kind of financing method with strong adaptability that is produced when the market economy develops to a certain stage. It is a new type of trading method that was produced in the United States in the 1950s. Because it adapts to the requirements of modern economic development, it developed rapidly in the 1960s-1970s all over the world. Today, it has become one of the main financing means for enterprises to update equipment, and it is known as "sunrise industry" " After the introduction of this business mode in the early 1980s, China has also achieved rapid development in more than 30 years. However, compared with developed countries, the advantages of leasing are far from being realized and the market potential is great.

Difference from installment

(1) Installment payment is a kind of transaction in which the buyer not only obtains the right to use the traded goods, but also obtains the ownership of the goods. Financial leasing is a kind of leasing behavior. Although the lessee actually bears the cost and risk caused by the leased property, the ownership of the leased property still belongs to the lessor in name.

(2) Financial leasing and installment payment are also different in accounting treatment. In the financial lease, the ownership of the lease item belongs to the lessor, and the lease item is regarded as a long-term receivable; the lessee is included in the fixed assets for depreciation. The items purchased on instalments are owned by the buyer and are therefore included in the buyer's balance sheet and depreciated by the buyer.

(3) The above two lead to differences in tax treatment. In financial leasing, the lessor can deduct the amortized depreciation from the accrued income, while the lessee can deduct the amortized depreciation from the taxable income, in installment transaction, the buyer can deduct the amortized depreciation from the taxable income, the buyer can also deduct the interest cost of the expenses from the taxable income, in addition, the buyer can purchase some fixed assets in some western regions China can also enjoy tax-free investment.

(4) In terms of term, the payment term of installment is often lower than the economic life of the traded goods, while the lease term of financial leasing is often the same as the economic life of the leased goods. As a result, the term of credit for the same goods obtained by financial leasing is longer than that obtained by installment payment.

(5) Installment payment is not full credit, and the buyer usually needs to pay part of the loan at sight; while financial leasing is a full credit, which provides financing for all the rental price and even the additional costs of transportation, insurance, installation, etc. Although financial leasing usually needs to pay a certain amount of deposit at the beginning of the lease, this fee is generally much less than the spot payment amount required by the installment transaction (for example, in the import and export trade, the buyer needs to pay at least 15% of the payment in cash). Therefore, for the same item, the total amount of credit provided by financial leasing is generally larger than that provided by installment trading.

(6) There are also differences in payment time between financial leasing and installment transactions. The former is generally at the end of each period, usually before the installment, there is a grace period. The installment generally has no grace period, and the rent needs to be paid after the transaction begins. Therefore, the installment payment is usually at the beginning of each period.

(7) At the expiration of the financial lease term, the lease item usually has residual value, and the lessee generally can't deal with the lease item arbitrarily, and needs to go through the exchange procedures or purchase procedures. And the buyer of installment transaction has the goods after the stipulated installment, which can be disposed of arbitrarily.

(8) The object of financial leasing is generally the items with long life and high value, such as machinery and equipment.